This analysis is based on the Prime Minister of Papua New

Guinea (PNG) response to series of questions from the Opposition. Including latest report from the nation’s television broadcaster EMTV news on Liquefied

Natural Gas (LNG) production in the country.

Many Papua New Guineans thought the US$19 billion earmarked

for PNGLNG development was a huge investment. The amount actually spent was

less. A report from EMTV revealed that

ExxonMobil saved over US$8 billion during construction phase.

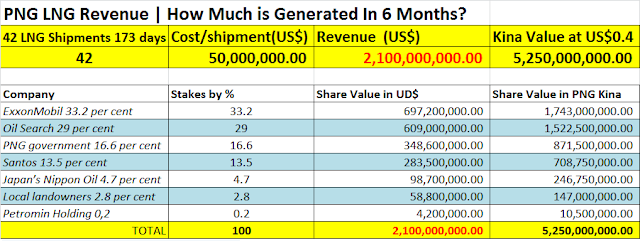

To date over 42 shipments have left PNG shores.The Prime Minister, Peter O’Neill, when responding to Deputy Opposition leader questions about the shipments of LNG products, said a shipment was valued at US$50, 000, 000 on average.

Expenditure margin has been reduced when ExxonMobil moved from development to production. Perhaps it is important to consider the

savings of US£8 billion - a savings of 30% . Another good news for

shareholders is that the company is likely to recover all the development costs

– US$11 billion – in just 5 years.

For clarity: if 42 shipments worth on average US$50 000 000

each, ExxonMobile has made US$2.1 billion in six months. Double it to give

US$4.2 billion in one year. So, in 5 years if oil price averages at the current

rate, the project would have made US$21 billion.

So what does that mean? That means that the every

shareholder would enjoy the fruit of their investments. What is not so right is

the fact that PNG Government has borrowed heavily to partake in this business.

So, who is going to benefit from PNG LNG project?