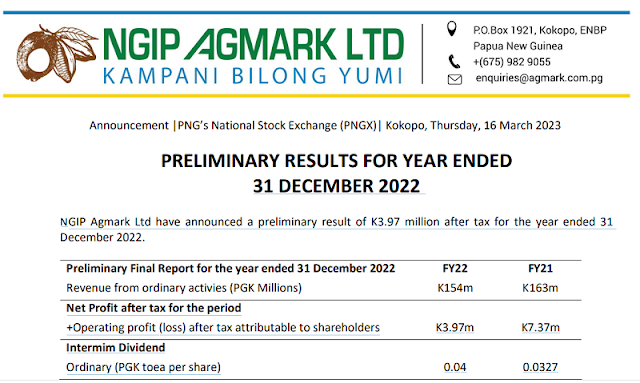

NGIP Agmark Limited has announced a preliminary result of K3.97 million after tax for the year ended December 31, 2022. This is a decrease in revenue by K9.4m or 6.33% due to diminished sales in cocoa and coffee exports. However, the company still managed to declare a profit for FY22, proving its resilience despite a challenging year.

NGIP Agmark Limited Decrease in Revenue

The decrease in revenue was mainly due to a drought that hindered cocoa production for most of the year, leading to a significant drop in revenue compared to the previous year.

However, through key initiatives from past experiences, combined with a robust reporting system and a streamlined management structure, NGIP Agmark Limited was able to minimize costs and take advantage of profit-making opportunities to ensure a profit for FY22.

The company's cost of sales decreased by K8m or 7.5% in FY22, and admin and finance costs grew by 1.31m or 2.8%, mainly due to occupancy costs.

Despite the increase in occupancy costs, the company closed underperforming branches in the previous year, resulting in a 22% decrease in occupancy costs in FY21.

NGIP Agmark Limited Dividend Payout

During the AGM held in June 2022, the board announced a dividend payout for the FY21 performance of the audited K7.3M profit after tax. A distribution of K0.04 per share was paid in November 2022, marking the second consecutive year that a dividend was paid.

Throughout FY22, the company continued to focus on supporting its customers, especially the cocoa farmers, and solidifying strong relationships with suppliers, providing shareholder value through the challenges of 2022.

Looking forward, NGIP Agmark Limited

Looking forward, NGIP Agmark Limited aims to:

- continue its expansion plans, focusing on investing in technology to improve operational efficiency, and

- enhance customer experience, while also exploring new markets and business opportunities to grow the company's revenue and profitability.

Investors' Takeaway

- Despite facing a challenging year due to a drought that hindered cocoa production, NGIP Agmark Limited managed to declare a profit for FY22, demonstrating the company's resilience and strength.

- The company's focus on cost optimization and taking advantage of profit-making opportunities helped minimize costs and achieve profitability.

- NGIP Agmark Limited paid dividends for two consecutive years, indicating its commitment to creating value for shareholders.

- The company's investment in technology to improve operational efficiency and customer experience, coupled with its exploration of new markets and business opportunities, bodes well for its future growth and profitability.

- NGIP Agmark Limited's continued focus on supporting its customers, especially cocoa farmers, and building strong relationships with suppliers reinforces the company's commitment to its stakeholders and sustainable growth.

In Brief

Despite the challenges faced by NGIP Agmark Limited in FY22, the company has shown resilience and strength, delivering a profit and paying dividends to its shareholders.

The company's focus on cost optimization and investment in new technology and markets bodes well for its future growth and profitability.