Credit Corporation PNG has reported its financial results for the financial year ending December 31, 2022.

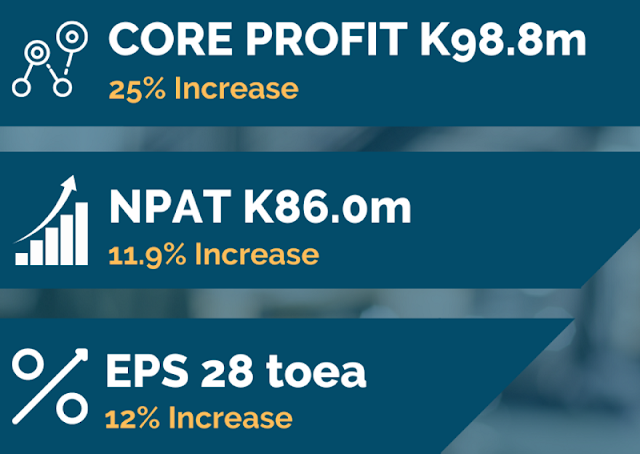

- The company's core operating profit was K98.8m, up 25.0% from the previous corresponding period (PCP).

- The net profit after tax (NPAT) was K86.04m, an increase of 11.9%.

- The company's earnings per share rose from 25 toea to 28 toea per share.

- The total risk-weighted capital ratio increased from 40.1% to 45.0%.

- The dividend per share for FY22 was 22.5 toea, up 25.0% from the previous year.

Download the full report here.

Credit Corporation PNG dividend income

The Finance Division of Credit Corporation had an NPAT of K36.6m, up 41.9% from the PCP, while the Property Division recorded a core operating profit of K13.4m, up 31.0% from the PCP.

The company's dividend income increased from K52.9m to K61.5m.

Credit Corporation PNG Commercial Bank 'Approval'

Credit Corporation is transitioning to becoming a fully-fledged niche commercial bank, and the Bank of PNG granted it 'Approval in Principle' for an unrestricted banking license.

The company's outlook is positive, and it will continue to focus on pursuing growth opportunities while maintaining a strong balance sheet and disciplined approach to managing the quality of its loan book.

Investors' takeaway

For investors, the key takeaways are that Credit Corporation's financial performance for FY22 was strong, with an increase in profitability, earnings per share, and dividend per share.

The company's decision to transition to a fully-fledged niche commercial bank and its Approval in Principle from the Bank of PNG for an unrestricted banking license are important developments to watch.

The company's focus on disciplined management of its loan book and strong balance sheet is reassuring for investors.

Read about how to invest in PNG Stocks, Treasury Bills and Government Bonds.

In Brief:

Credit Corporation PNG has reported a strong financial performance in FY22, including a 25% increase in core operating profit and 11.9% rise in NPAT. The Group's total risk-weighted capital ratio rose to 45%, while its property division recorded a core operating profit of K13.4m. Credit Corporation also declared a final dividend for FY22 of 12.3 toea per share, a 25% increase compared to FY21. The Bank of Papua New Guinea granted the company 'Approval in Principle' for an unrestricted banking license, allowing it to transition to becoming a bank and ultimately listing on the ASX.