CPL Group, the leading retail group in Papua New Guinea, has announced its financial results for FY2022. There are some good news for investors looking to earn more from their investments.

Despite tough business conditions and disruptions due to the National Elections, the

- company's revenue grew by 5.1%,

- profit after tax was K15.5m, and

- dividend declared for FY2022 is 25% higher than FY2021, at 5 toea per share.

Download the CLP Croup Financial Report FY2022, PDF

City Pharmacy Limited

The company's parent company, City Pharmacy Limited, which operates pharmacy outlets across Papua New Guinea and Stop & Shop supermarkets in Port Moresby, experienced revenue growth of 5.1%.

Meanwhile, the home and lifestyle brand Hardware Haus maintained its market position from the previous year.

Joint venture businesses, Jacks of PNG and Prouds PNG, contributed significantly to the company's financial growth, with a steep incline of 150% compared to the previous financial year.

CPL Group's expansion

CPL Group's expansion efforts were also successful, with the opening of four new retail locations across the country, including Hardware Haus in Goroka and North Waigani, Port Moresby, and City Pharmacy in Kundiawa and Eriku in Lae.

This brings the total number of retail outlets to 78 across PNG, including joint venture businesses.

CPL Group Dividend Payment

For shareholders, the:

- ex-date for dividend payment is on March 22nd, 2023,

- record date is on May 1st, 2023, and

- payment date is May 30th, 2023.

This information is crucial for shareholders to receive their dividend payments on time.

CPL Group's commitment to delivering outstanding value and exceptional customer service for its communities, customers, suppliers, and team members is evident.

The company's aim to be the preferred shopping destination in Papua New Guinea shows its dedication to its customers' needs.

As the company ventures into the next 12 months, it will remain focused on ensuring shareholder value.

Investors takeaway

According to the FY2022 financial statement released by CPL Group, the company opened four new retail locations across Papua New Guinea. These new locations are:

- Hardware Haus in Goroka

- Hardware Haus in North Waigani, Port Moresby

- City Pharmacy in Kundiawa

- City Pharmacy in Eriku, Lae

In Brief

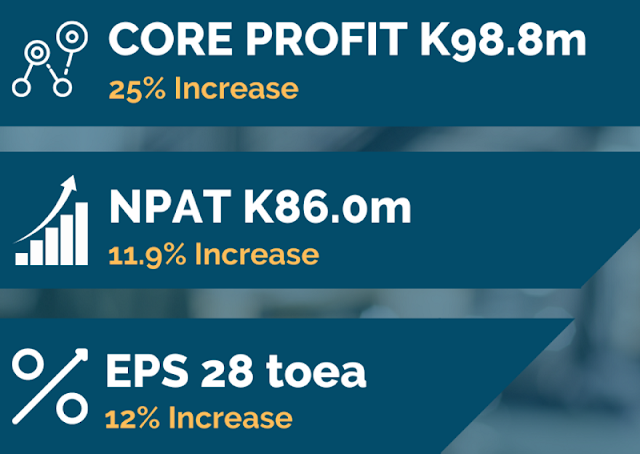

ICPL Group's FY2022 financial statement shows steady growth despite tough business conditions and disruptions.

The company's financial performance is impressive, with a 25% increase in dividend payments compared to the previous year.

Its expansion efforts and commitment to delivering outstanding value and exceptional customer service make it a promising investment opportunity for investors looking for long-term growth potential.