The International Monetary Fund (IMF) has approved a 38-month Extended Credit Facility (ECF) and Extended Fund Facility (EFF) for Papua New Guinea (PNG) in the amount of SDR684.3 million, equivalent to $918 million, to address the economic impacts of multiple shocks, including low commodity prices, drought, earthquakes, and the COVID-19 pandemic.

See the definitions of ECF and EFF at the end of this article.

Reforms

The program aims to protect vulnerable groups and promote inclusive growth through debt sustainability, foreign exchange (FX) shortage alleviation, and enhanced governance and anti-corruption efforts.

The IMF believes that the program will support and enhance PNG's credibility and improve its access to international financial markets.

What is not clear is what 'exactly' is/are changing and how the changes will affect the institutions and the people they serve.

Key Rates

The IMF loan will be subject to a 2.4% interest rate, lower than the current weighted average interest rate for external loans (2.8%) and domestic loans (7.2%).

Repayment will be over a ten-year period, with a 5.5-year grace period.

It may seem like a good deal, but a loan is a loan. And, an IMF loan that comes with institutional reformations and conditions has a lot to be desired.

If it sounds too good to be true, it probably is.

Pros and Cons of the IMF loans

Pros:

- The loan will provide much-needed financial support to the PNG government and enhance its credibility.

- The loan will help repair public finances and alleviate pressure on government spending.

- Priority areas for capital expenditure in the 2023 budget include transport, utilities, education and health.

- The IMF's support will improve PNG's access to international financial markets.

Cons:

- Phased disbursement of the loan will be conditional on progress against benchmarks that are yet to be made public. (This is IMF's secret weapon, it can do what it thinks is best, and as it pleases - not good for PNG.)

- The IMF will seek exchange-rate liberalisation, financial-sector deepening, and state-owned enterprise (SOE) reform under the new program, which may not align with recent steps taken by PNG to protect local industries through higher tariffs and ad hoc tax increases. This will be forced upon the PNG government whether it likes it or not!

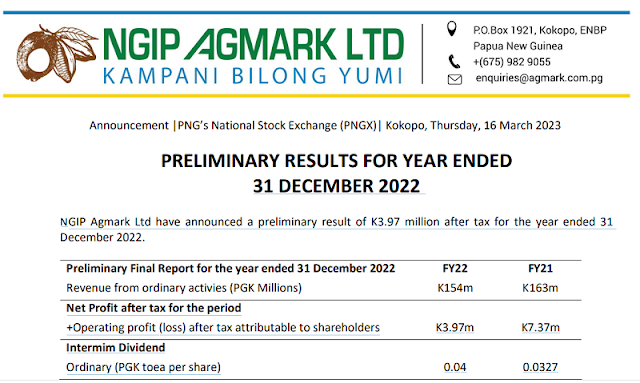

- The loan does not significantly change risk around PNG's debt profile, which stands at K48.3bn.

- Continued policy reforms and international support are needed to address PNG's vulnerability to domestic and external shocks. (The details of the reforms are not clear)

Read about the 9 structural benchmarks that IMF is setting for PNG, Click Here.

IMF Push Reforms

The IMF's approval of the ECF and EFF is a significant development for PNG, but policy reforms and international support are still needed to address the country's vulnerability to economic shocks.

While the loan's generous terms will help to contain repayment risk, the government must prioritize debt sustainability and FX shortage alleviation to address PNG's most pressing challenges.

Extended Credit Facility (ECF) and Extended Fund Facility (EFF)

Notes on: ''The International Monetary Fund has approved a 38-month Extended Credit Facility (ECF) and Extended Fund Facility (EFF) for Papua New Guinea ''

The ECF and EFF are both lending arrangements that provide financial assistance to countries facing balance of payments difficulties. The ECF is a medium-term lending facility, while the EFF is a longer-term lending facility.

The ECF for PNG is designed to provide financial support to the country over a period of 38 months, while the EFF provides support over a longer period of time. The purpose of both facilities is to help PNG address its economic challenges while also implementing necessary structural reforms that can promote sustained economic growth and development.

The recent purported IMF debt facilities are a blended model pegged to 38 months and a further 10 years depending on IMF's ongoing situation analysis.

The policy conditions attached to both facilities include measures to strengthen public financial management, enhance revenue mobilization, improve the business climate, and address governance challenges. These reforms are intended to help restore macroeconomic stability and promote sustained economic growth and development in PNG.

The approval of both the ECF and EFF programs are conditional on IMF reforms in Papua New Guinea.