Two letters were released on two important political developments on the same day, Friday the 14th of November. The first was the 'unexpected' referral of the Prime Minister, Peter O'Neill, to Leadership Tribunal. Second is a letter from the Chief Secretary of Government seeking cooperation from department heads to minimise pressure on 2014 Budget.

The PM and Minister for Treasury indicated that 2015 Budget was on course. Their intentions were to showcase to every citizen and overseas friend that all is under control. As long as there are no confirmed data to support the Budget presentation, no one will believe them.

Government circular No. 05/2014 indicated that all is not too well. Chief Secretary to the Government circular implied that treasury could run dry before the end of the financial year. Every financial year ends in March. Does it mean that department heads have not followed tight monetary policy over the last 8 months? Why this letter is 'urgent'?

The reasons why the heads should take cost-cutting measures detailed in Circular Instruction No. 05/2014 are indicative. This means that those reasons are used as smokescreen to divert attention from nonconformity to 'strict fiscal conditions set in 2014 Budget'.

The reality is obvious. Take a look at the facts associated with commodity prices, overspending and Government Debt.

1. Decline in tax revenues due to falls in some key commodity prices

Gold and silver prices have fallen after the financial crises, but oil and gas prices are at record high due to high demand from South East Asian Countries like Japan and Taiwan. Coffee price is at its peak, including other agricultural commodities.

The problem is that government has neglected Agricultural commodities, instead it places value on Gold, Silver and Oil and Gas.

2. Increased costs associated with the completion of facilities for the 2015 South Pacific Games

Preparation of the SPG has put a lot of strain on 2014 Budget. The games committee has overspent and requested more. The Government initially allocated AU$9 million, about PNG K1.2 billion when Don Polye was the treasurer. The estimated budget for the games is AU$342 million (over PGK760 million)

One only wonders if such an amount would not eat into Government Budget.

3. Increased costs on Government debt

Current government treasurer, in his 2015 Budget speech, said budget deficit is at K77 million and not K2.35 billion as expected from 2014 Budget. This is an oversight or deliberate attempt to divert from real debt. The amount does not include PNGK6 billion (about AU$2.7 billion) China's Exim Bank loan. The treasurer did not include the loan from Swiss bank UBS worth almost PNGK2.6 billion (AU$1.2 billion).

It was reported that public debt service to cover interest payments stands at K3.7 billion. Does this include both loans? What is the actual deficit brought forward from 2014? All these have to be factored into 2015 Budget and printed for all to see.

In fact, PNG government has accrued a total debt of more than PNGK8.6 billion (K6b + K2.6b) since the Exim Bank loan. (That does not include other borrowings or repayments. or public debt of K3.7 billion or deficit from 2014 Budget of K2.35 billion).

The conservative amount of K8.6 billion is factual based on both loans The nation's 2015 budget is around K16 billion. From the outset, one can see that debt level is at half the PNG's Annual Budget.

Papua New Guineans and commentators have to see this figures clearly, and as it should be seen. The government has to tell us how much it has paid back. 2015 budget has to reflect all these figures in entirety.

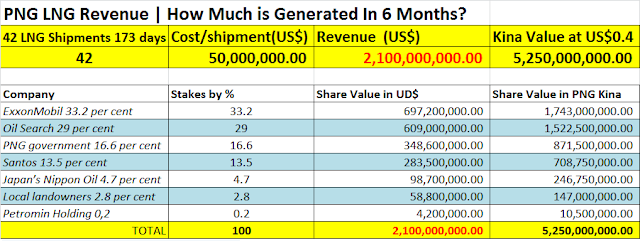

Apparently, Government of Papua New Guinea is placing all its hope on revenue from PNG LNG project. This is what the Prime Minister said in response to series of questions from the ABC news:

"GARRETT: You've just announced a 6 billion kina loan from China's Exim bank - that's worth almost 2.7 billion dollars. Critics say that is too big for PNG's budget. How do you respond?

O'NEILL: I think they underestimate Papua New Guinea's growth that is happening in the country. We are growing at an average of 8% over the last 10 years. We expect that growth to continue. We expect our economy to double by 2014. Our infrastructure in the country is declining to a state where some infrastructures are not able to cope with the demands of our people and our ecomomy. So when you look at this what solutions do you have? We need to program a massive overhauling and redevelopment of many of these infrastructures, particularly the transport systems in the country, and we are doing that by borrowing large sums of money. It sounds large but the draw down will not be in one single year. We are managing it prudently through our fiscal strategies that we have put in place and the projects are not going to be completed in one single cycle of a budget. So I don't think the stress levels will be that noticeable as the economy continues to grow. So I think our critics that are out there now stating that we are not able to manage such a large loan that has been sought through the Exim Bank of China we say this 'Do you want us to allow our infrastructures to continue declining? Do you want us to allow the economy to slow down and that there is no economic growth in the country? Do you want us to allow the unemployment figures to continue to rise?' Because when the economy does not grow the unemployment increases, all the other social sectors will decline. That is not a responsibility this government is prepared to accept. That is why the onus is on myself and the government to make sure that we rebuild the infrastructure in the country"

The stress level is clearly reflected in Chief Secretary's circular. The good news is that PNG LNG gas revenue will into government coffers starting 2015.

Above all we must consider that PNG government will make just over K1 billion from its 16.8% stakes in the LNG project next year. Government's 10% stakes (149.4 million shares) in Oil Search contributes just over K70 million in first year of full production which is 2015. So, the anticipated revenue from the LNG project would contribute under K2 billion to Budget 2015.

It is certainly true that the Governments of Sir Michael Somare and Peter O'Neill have erred in using the PNG project as platform for more borrowing. PNG's budget has not doubled this year, not even next year when one takes a closer look at the rate of growth and debt level.

The country is likely to plunge deeper into debt.

The Sihereni coffee estate, owned and operated by David Orimarie in the Kwonghi area of Upper Asaro Local Level Government in Daulo District of Eastern Highlands Province won the 3rd placing among a total of 30 coffee samples of different coffee producing countries collected by Ecom Trading around the world.

The Sihereni coffee estate, owned and operated by David Orimarie in the Kwonghi area of Upper Asaro Local Level Government in Daulo District of Eastern Highlands Province won the 3rd placing among a total of 30 coffee samples of different coffee producing countries collected by Ecom Trading around the world.